What is the good credit score in Canada?

Summary of the Article: What is the good credit score in Canada?

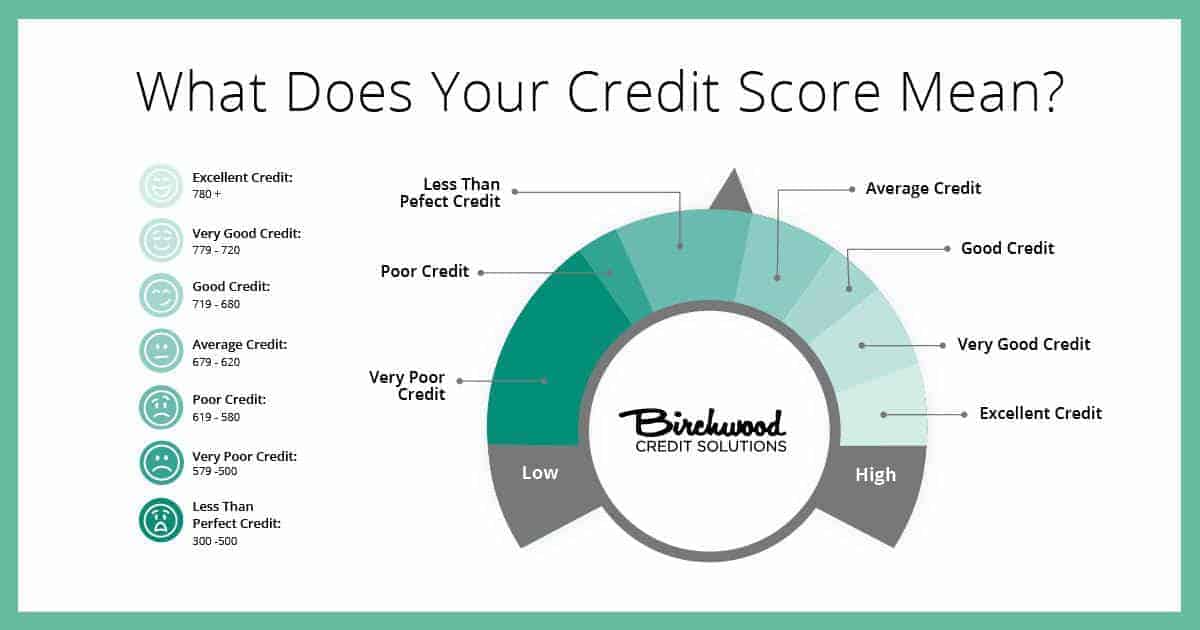

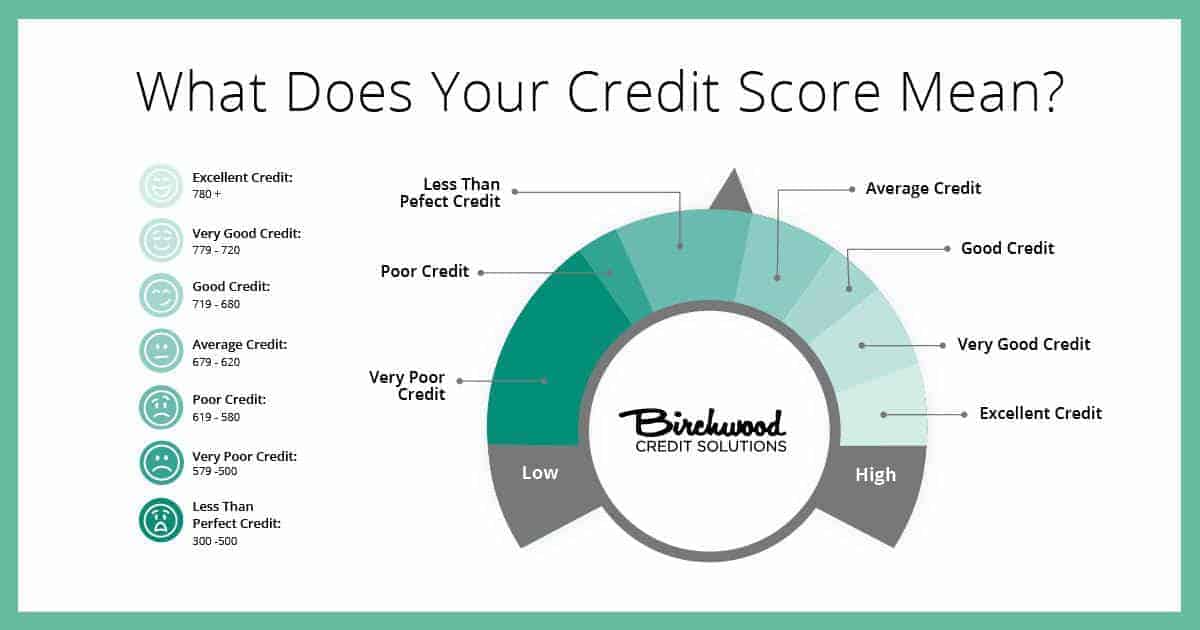

1. In Canada, credit scores range from 300 to 900, with 900 being a perfect score. A score between 780 and 900 is considered excellent.

2. The credit score range in Canada is similar to the range in the United States, which is usually from 300 to 850.

3. The average credit score in Canada is around 650, according to TransUnion. Most Canadians have fair credit, though some lenders may consider 650 as good.

4. A credit score of 800 in Canada can provide benefits such as lower interest credit cards, better rewards, and easier approval for mortgage or car loans.

5. Only 23% of the scorable population in Canada has a credit score of 800 or above, according to a report by FICO.

6. It is not easy to achieve an 800 credit score in Canada, as statistics show only about 17% of Canadians have reached this level.

7. Canadian merchants accept Visa, Mastercard, and American Express credit cards. Canada uses Interac Direct Payment (IDP) for debit or travel card transactions.

8. It is possible to build a U.S. credit rating while living in Canada. Steps to establish it include securing a U.S. mailing address and opening three loan accounts.

9. The average credit score in the United States is 698, with credit scores ranging from 580 to 850, depending on the scoring model.

10. In the U.S., credit scores from 670 to 739 are considered good, while scores of 800 and above are considered excellent.

11. Achieving a credit score of 900 is very rare and not realistic for most individuals.

Questions:

- Does anyone have a 900 credit score in Canada?

- Is the Canadian credit score the same as in the United States?

- What is the average credit score in Canada?

- What can a credit score of 800 get you in Canada?

- Is an 800 credit score rare?

- How hard is it to get an 800 credit score in Canada?

- Does Canada accept U.S. credit?

- Can you build U.S. credit while in Canada?

- What is the average credit score in the United States?

- What is considered a good credit score in the United States?

- Does anyone have a 900 credit score?

Answers:

1. In Canada, credit scores range from 300 to 900, so it is possible for someone to have a 900 credit score. However, it is extremely rare and not something that most individuals achieve.

2. The credit score range in Canada is similar to the range in the United States, although the numerical values differ. In both countries, higher credit scores are desirable.

3. The average credit score in Canada is around 650, according to TransUnion. This score is considered fair, although some lenders may view it as good.

4. With a credit score of 800 in Canada, you can expect to enjoy benefits such as lower interest rates on credit cards, better rewards, and easier approval for loans such as mortgages or car loans.

5. A credit score of 800 is considered rare, with only 23% of the scorable population in Canada achieving this level, according to a report by FICO.

6. Achieving an 800 credit score in Canada is not easy, as statistics show that only around 17% of Canadians have reached this level.

7. Canadian merchants accept Visa, Mastercard, and American Express credit cards. If you are paying with your debit or travel card, you can use the Interac Direct Payment (IDP) system to get cash out over-the-counter.

8. While living in Canada, it is possible to build a U.S. credit rating. To do so, you will need to secure a U.S. mailing address and open three loan accounts, such as credit cards or personal lines of credit.

9. The average credit score in the United States is 698, based on VantageScore® data from February 2021. It is important to note that individuals have multiple credit scores.

10. In the United States, credit scores from 670 to 739 are considered good, while scores of 800 and above are considered excellent.

11. While it is possible to have a credit score of 900, only a small percentage of the population can achieve it. For most people, aiming for the highest possible credit score may not be realistic.

Does anyone have a 900 credit score Canada

In Canada, your credit score ranges from 300 to 900, 900 being a perfect score. If you have a score between 780 and 900, that's excellent. If your score is between 700 and 780, that's considered a strong score and you shouldn't have too much trouble getting approved with a great rate.

Is Canadian credit score same as us

In Canada, your credit score will range from 300-900, while in America, scores usually range from 300-850. Although they function in very much the same way, in that you're looking for a high score.

What is Canada’s average credit score

around 650

The Average Canadian Credit Scores

According to TransUnion (one of the two main credit reporting bureaus in Canada), the average Canadian credit score is around 650. Based on the credit score ranges we discussed above, most Canadians have fair credit, though some lenders may consider 650 as good.

What can a 800 credit score get you in Canada

Benefits of a 800 Credit Score

This is because higher credit scores help to prove how financially responsible you are. With a score of 800 you are also likely to get approved for lower interest credit cards and better rewards. A high credit score also helps you get a mortgage or car loan.

Is 800 credit score rare

According to a report by FICO, only 23% of the scorable population has a credit score of 800 or above.

How hard is it to get a 800 credit score in Canada

However, statistics show that roughly 1 out of every seven Canadians have an 800 credit score, which is about 17% of people. In essence, an 800 credit score is not so easy to come by.

Does Canada accept US credit

Canadian merchants accept Visa, Mastercard and American Express credit cards. Canada uses Interac Direct Payment (IDP) and you can use this system to get cash out over-the-counter if you're paying with your debit or travel card.

Can you build US credit in Canada

Establishing a U.S. credit rating isn't difficult; however, there are a few steps you'll need to take to start building it south of the border. These include: Secure a U.S. mailing address. Open three loan accounts, such as a bank-issued credit card, department store credit card or personal line of credit.

What is the average credit score in USA

The average credit score in the United States is 698, based on VantageScore® data from February 2021. It's a myth that you only have one credit score. In fact, you have many credit scores. It's a good idea to check your credit scores regularly.

What is a good credit score in USA

670 to 739

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair; 670 to 739 are considered good; 740 to 799 are considered very good; and 800 and up are considered excellent.

Does anyone have 900 credit score

A 900 credit score may be the highest on some scoring models, but this number isn't always possible. Only 1% of the population can achieve a credit score of 850, so there's a certain point where trying to get the highest possible credit score isn't realistic at all.

How rare is credit score over 800

According to a report by FICO, only 23% of the scorable population has a credit score of 800 or above.

Is A 900 credit score good

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair; 670 to 739 are considered good; 740 to 799 are considered very good; and 800 and up are considered excellent.

Can you get a 900 credit score

FICO® score ranges vary — either from 300 to 850 or 250 to 900, depending on the scoring model. The higher the score, the better your credit.

How to raise credit score 100 points in 30 days

Quick checklist: how to raise your credit score in 30 daysMake sure your credit report is accurate.Sign up for Credit Karma.Pay bills on time.Use credit cards responsibly.Pay down a credit card or loan.Increase your credit limit on current cards.Make payments two times a month.Consolidate your debt.

Can I use my US bank card in Canada

Yes. Cards issued by U.S. Bank can be used in most foreign countries for transactions.

Why use a US credit card in Canada

With a U.S. dollar credit card, your purchases are charged and paid for in U.S. dollars only, so you save on U.S. currency conversion fees. With a no foreign transaction fee credit card, your cross-border purchases are charged in Canadian dollars, but your foreign transaction fee is waived.

Does Canada use FICO score

Solution Sheet

In the U.S. and Canada, hundreds of lenders are participating in the FICO® Score Open Access program to provide FICO® Scores to consumers for free. Ninety percent (90%) of top Canadian lenders and credit unions use FICO® Scores.

Can you move to Canada with U.S. debt

Technically, yes, but it's so costly that most collectors wouldn't bother going through the process. In order to pursue you in Canada, the collector or lender would first need to get a judgment against you in a U.S. court. Then they'd need to bring that judgment to a Canadian court to have it acknowledged in Canada.

How many Americans have over 700 credit score

The latest data reveals that 16.4% of Americans have a FICO score of between 700 and 749. With 23.1% of consumers with a credit score between 750 and 799 and 23.3% of Americans in the highest credit score percentile, a total of 62.8% of the US population have a credit score over 700.

How rare is 800 credit score

According to a report by FICO, only 23% of the scorable population has a credit score of 800 or above.

Does anyone have an 850 credit score

While achieving a perfect 850 credit score is rare, it's not impossible. About 1.3% of consumers have one, according to Experian's latest data. FICO scores can range anywhere from 300 to 850. The average score was 714, as of 2021.

How rare is a 750 credit score

Your credit score helps lenders decide if you qualify for products like credit cards and loans, and your interest rate. You are one of the 46% of Americans who had a score of 750 or above in 2021, according to credit scoring company FICO. Here's how your 750 credit score can affect your financial life.

Has anyone gotten a 850 credit score

While achieving a perfect 850 credit score is rare, it's not impossible. About 1.3% of consumers have one, according to Experian's latest data. FICO scores can range anywhere from 300 to 850. The average score was 714, as of 2021.

What does a 800 credit score get you

An 800-plus credit score shows lenders you are an exceptional borrower. You may qualify for better mortgage and auto loan terms with a high credit score. You may also qualify for credit cards with better rewards and perks, such as access to airport lounges and free hotel breakfasts.